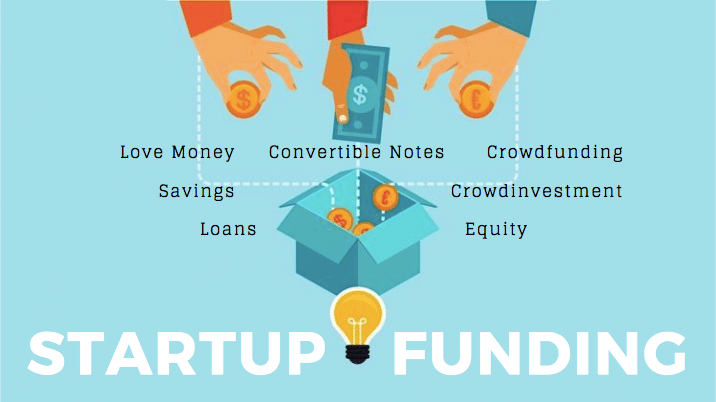

What is Startup Financing?

Startup financing is the process of securing the capital necessary to start and grow a new business. It allows entrepreneurs to cover initial costs such as product development, marketing, hiring staff, and other operational expenses. There are various types of startup financing sources available, each with its own advantages and disadvantages. These sources include personal savings, loans, angel investors, venture capital, and crowdfunding.

Types of Startup Financing

There are several types of financing options available for startups. Each option offers unique benefits, so it's important to carefully consider which one suits your business model.

| Financing Option | Description | Pros | Cons |

|---|---|---|---|

| Personal Savings | Using personal funds to finance the business. | No repayment obligations. | Risks personal financial stability. |

| Friends and Family | Borrowing money from friends or family members. | Flexible repayment terms. | Potential strain on personal relationships. |

| Bank Loans | Traditional loans from banks or credit unions. | Predictable terms and interest rates. | Difficult to qualify for. |

| Angel Investors | High-net-worth individuals who invest in exchange for equity. | Expert guidance and mentorship. | Giving up equity in the business. |

| Venture Capital | Funding from firms in exchange for equity ownership. | Large amounts of funding. | Loss of control and equity. |

| Crowdfunding | Raising small amounts of money from a large number of people, typically via online platforms. | Validates business ideas and attracts interest. | Time-consuming and uncertain. |

Benefits of Startup Financing

Securing startup financing provides several key benefits for entrepreneurs. These include:

- Business Expansion: With the right funds, you can expand your business operations, hire key staff, and invest in marketing strategies.

- Scalability: Access to funding can help you scale quickly, allowing you to grow your business and reach more customers.

- Product Development: Funding allows for investment in the development of your products or services, ensuring they meet market needs and customer expectations.

- Flexibility: Depending on the financing option, you may have more control over how funds are allocated, whether for day-to-day expenses or long-term development.

Key Considerations When Choosing Startup Financing

When deciding on the right startup financing option, keep these key factors in mind:

- Amount of Capital Needed: Understand how much funding your business requires to get off the ground and grow. Ensure the financing option you choose aligns with your financial goals.

- Repayment Terms: If you're considering loans, review the terms and interest rates to determine what you're comfortable with in terms of repayment.

- Ownership and Control: Decide if you're willing to give up a portion of ownership (equity financing) or if you prefer to maintain full control (debt financing).

- Risk Tolerance: Some financing options, such as venture capital or loans, come with a higher level of risk. Assess your ability to manage these risks.

Popular Sources of Startup Financing

| Source | Description | Best For |

|---|---|---|

| Bank Loans | Traditional loans for startups from financial institutions. | Established businesses with a solid credit history. |

| Angel Investors | High-net-worth individuals who provide capital in exchange for equity. | Early-stage startups with high growth potential. |

| Venture Capitalists | Investment firms that provide funding for startups in exchange for equity. | Tech startups or businesses with significant scalability potential. |

| Crowdfunding Platforms | Online platforms where many individuals contribute to fund your startup. | Startups with unique consumer-facing products or ideas. |

Conclusion

In conclusion, startup financing is a critical part of launching and growing a successful business. By exploring the different financing options available, such as bank loans, angel investors, and venture capital, you can make an informed decision about the best route for your startup. Remember to evaluate your business needs, the amount of funding required, and your risk tolerance when choosing the right financing method.

With the right startup financing strategy, your business can thrive and achieve long-term success.